How to Fix Your Credit

Having poor credit is nerve-racking and may lead to you paying extra money than individuals with sensible credit once you attend finance a automobile or obtain a house. However, there is no have to be compelled to rent a credit repair company that claims they'll fix your credit woes. In reality, these corporations do not do something you cannot do yourself for gratis. Like losing weight, it takes time and energy to realize monetary fitness. Work thereon a touch daily and eventually you'll need a credit score you'll be happy with.[1]

Method:1-Correcting Errors on Your Credit Report

1-Get a replica of all 3 credit reports. Federal law entitles you to one free credit report from every of the three major credit bureaus each twelve months. to induce your free credit reports, attend https://www.annualcreditreport.com/index.action and click on the button to request your reports.[2]

Tip: you'll additionally order free copies of your credit reports by business 1-877-322-8228.

2-Compare your credit report together with your own records. browse through every of the reports rigorously and determine every account listed. Check your own records to form positive the account standing, balance, and payments created ar correct.[3]

3-Write a letter to the appropriate credit bureau disputing any errors. embrace the page of your credit report wherever you have highlighted the error, still as the other documentation you have got that may prove the entry was wrong. albeit the credit bureaus enable you to dispute the record on-line, it's still higher to send a written letter therefore you have got a record of the dispute.[4]

Tip: you'll additionally wish to send an analogous letter to the someone that provided the data. typically they're faster to act than the agency. you'll notice the address listed on your credit report at the side of the entry.

4-Mail your letter and supporting documentation to the credit bureau. Before you mail your letter, create a replica of the signed letter for your records. Then send it mistreatment certified mail with came receipt requested. once you get the positive identification back, keep it together with your copy of your dispute letter as proof of delivery. Use the subsequent addresses:[5]

5-Follow up to form positive the error is corrected. The agency can investigate the entry and forward your documents and data to the someone that provided the data for the entry. you'll receive notice from the agency once the investigation is complete, generally inside thirty days. you may still wish to appear at your credit report back to verify the data has been modified.[6]

If the agency determines that the entry is truly correct, you'll raise them to place a note on the entry explaining that you simply dispute it. though it will not have an effect on your credit score, anyone World Health Organization requests your credit report can see this note.

Method:2-Working together with your Creditors

1-Contact your creditors as shortly as doable if you cannot create the minimum payment. Creditors ar generally willing to figure with you if you are proactive. As shortly as you establish you will not be able to create your minimum monthly payment, decision the client service range for the someone and allow them to realize your state of affairs.[7]

Sample Script: Hi, I actually have a payment due on the fifteenth, however i do not assume i will be able to pay it. i used to be recently sick and have incomprehensible work as a result. i used to be questioning if I might get associate extension? I ought to be able to create the payment by the tip of the month.

2-Ask for a credit limit increase if you are carrying a high balance. Credit utilization makes up regarding half-hour of your credit score. If you are carrying a balance, it should not be over half-hour of your credit limit. If you are not able to pay down a high balance quickly, the someone is also willing to extend your credit limit. Then the balance are a smaller share of the quantity of credit you have got out there albeit it remains a similar quantity.

3-Negotiate a lower charge per unit on accounts you have had for a moment. If you have had a mastercard for many years and have a decent relationship with the mastercard company, you'll be able to get a lower charge per unit. If you are carrying a balance on the cardboard, this could keep you from obtaining additional into debt. analysis alternative credit cards that ar kind of like the one you have got and compare the interest rates offered.[8]

Sample Script: Hi, I've had associate account with you for six years and i have ne'er had a late payment. i might prefer to visit you regarding lowering my charge per unit. contestant Bank is presently providing an analogous card at seventeen.7% interest, that is considerably not up to my rate of twenty four.9%.

4-Pay for removal of assortment accounts. If you have got any credit accounts that have gone into collections, unremarkably the gathering entry would remain your credit report for seven years. However, you furthermore may have heaps of area to barter with assortment agencies and acquire the entry off from your credit report once you have paid the debt fully. These ar known as "pay for delete" agreements.[9]

Tip: Request a validation letter from the gathering agency before you pay them any cash to form positive you really owe the debt and that they have the correct to gather it.

Method:3-Using Credit Responsibly

1-Review what factors come in scheming your credit score. It will take months of diligence to induce your credit score wherever you would like it to be. Once you savvy there, attempt to stay it there or take it even higher. Knowing however your credit score is calculated will assist you remain prime of it. Generally, a FICO score is calculated in step with the following:[10]

Tip: detain mind that there is no single formula for evaluating your trustiness. completely different lenders or finance corporations could place weight on various factors, despite your overall credit score.

2-Create a monthly budget and continue it. All the diligence you place into fixing your credit can attend waste if you finish up obtaining yourself in debt once more as a result of you are over-extended. discover your actual net financial gain every month and deduct from that the bills you have got no management over, like your utilities, rent or mortgage payment, food, and transportation prices.[11]

3-Calculate truth price of high-ticket purchases before you purchase. It are often tempting to plonk a mastercard if you would like to shop for a replacement TV, vice system, or pc. however albeit your monthly payments is also comparatively low, you may pay heaps a lot of for that item in interest, particularly if it takes you many years to pay down the balance.[12]

Tip: If you are looking at a high-ticket item, attempt to use a card that gives no interest on massive purchases as long as you pay them off during a specific amount of your time. However, take care to browse the fine print. Some corporations can charge you accumulated interest on the remaining balance if you do not pay it off within the time assigned.

4-Pay your bills on time and full.

Method:1-Correcting Errors on Your Credit Report

|

| How to Fix Your Credit |

1-Get a replica of all 3 credit reports. Federal law entitles you to one free credit report from every of the three major credit bureaus each twelve months. to induce your free credit reports, attend https://www.annualcreditreport.com/index.action and click on the button to request your reports.[2]

- The reports you get from the free report website don't embrace your credit scores. They solely embrace the entries on your report. However, this can be all you wish to envision for errors.

Tip: you'll additionally order free copies of your credit reports by business 1-877-322-8228.

2-Compare your credit report together with your own records. browse through every of the reports rigorously and determine every account listed. Check your own records to form positive the account standing, balance, and payments created ar correct.[3]

- Not all creditors report back to all three credit bureaus, therefore confirm you bear this method with every of your three credit reports.

- If you discover associate entry on one in all your credit reports that does not match your own records, create a replica of that page of the credit report and highlight the entry. you'll have to send this to the agency at the side of a letter explaining the error if you would like to induce it corrected.

|

| How to Fix Your Credit |

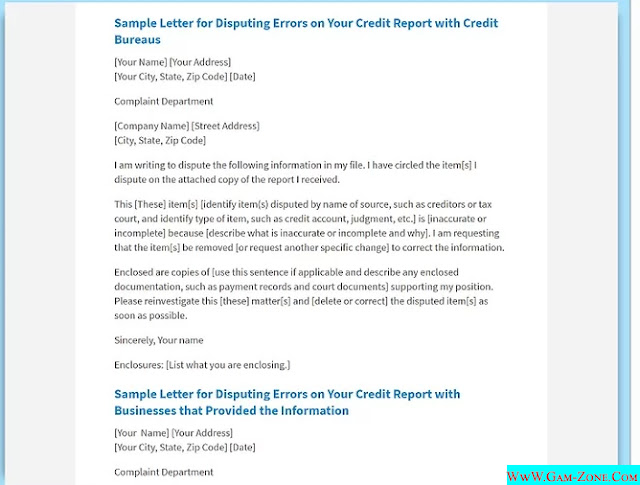

3-Write a letter to the appropriate credit bureau disputing any errors. embrace the page of your credit report wherever you have highlighted the error, still as the other documentation you have got that may prove the entry was wrong. albeit the credit bureaus enable you to dispute the record on-line, it's still higher to send a written letter therefore you have got a record of the dispute.[4]

- The Federal Trade Commission (FTC) encompasses a sample letter you'll adapt to fit your desires at https://www.consumer.ftc.gov/articles/fixing-your-credit.

Tip: you'll additionally wish to send an analogous letter to the someone that provided the data. typically they're faster to act than the agency. you'll notice the address listed on your credit report at the side of the entry.

4-Mail your letter and supporting documentation to the credit bureau. Before you mail your letter, create a replica of the signed letter for your records. Then send it mistreatment certified mail with came receipt requested. once you get the positive identification back, keep it together with your copy of your dispute letter as proof of delivery. Use the subsequent addresses:[5]

- Equifax: Equifax data Services LLC, PO Box 740256, Atlanta, GA 30348

- Experian: Experian, PO Box 4500, Allen, TX 75013

- TransUnion: TransUnion LLC, shopper Dispute Center, PO Box 2000, Chester, PA 19016

5-Follow up to form positive the error is corrected. The agency can investigate the entry and forward your documents and data to the someone that provided the data for the entry. you'll receive notice from the agency once the investigation is complete, generally inside thirty days. you may still wish to appear at your credit report back to verify the data has been modified.[6]

If the agency determines that the entry is truly correct, you'll raise them to place a note on the entry explaining that you simply dispute it. though it will not have an effect on your credit score, anyone World Health Organization requests your credit report can see this note.

Related Content:

Method:2-Working together with your Creditors

1-Contact your creditors as shortly as doable if you cannot create the minimum payment. Creditors ar generally willing to figure with you if you are proactive. As shortly as you establish you will not be able to create your minimum monthly payment, decision the client service range for the someone and allow them to realize your state of affairs.[7]

- When talking to a representative, tell them that you are involved you will not be able to create the minimum payment and allow them to apprehend the explanation. If you have got a decent plan once things are resolved, offer them a time-frame.

Sample Script: Hi, I actually have a payment due on the fifteenth, however i do not assume i will be able to pay it. i used to be recently sick and have incomprehensible work as a result. i used to be questioning if I might get associate extension? I ought to be able to create the payment by the tip of the month.

2-Ask for a credit limit increase if you are carrying a high balance. Credit utilization makes up regarding half-hour of your credit score. If you are carrying a balance, it should not be over half-hour of your credit limit. If you are not able to pay down a high balance quickly, the someone is also willing to extend your credit limit. Then the balance are a smaller share of the quantity of credit you have got out there albeit it remains a similar quantity.

- Credit card corporations ar generally a lot of inclined to convey you the next limit if you have got a decent credit score and a decent payment history with them, however notwithstanding you do not they still is also willing to figure with you.

3-Negotiate a lower charge per unit on accounts you have had for a moment. If you have had a mastercard for many years and have a decent relationship with the mastercard company, you'll be able to get a lower charge per unit. If you are carrying a balance on the cardboard, this could keep you from obtaining additional into debt. analysis alternative credit cards that ar kind of like the one you have got and compare the interest rates offered.[8]

- Keep all of your data handy and decision your credit card's client service range. enlighten the representative the explanation for your decision, and prompt them of your sensible relationship with the corporate. Then, allow them to apprehend that you've got been looking around which their competitors supply a lower rate.

- While it's true that mastercard corporations are a lot of possible to lower your charge per unit if you have got a decent credit score, it ne'er hurts to raise. The bourgeois could even provide you with tips about what you wish to try to to to be eligible for a lower charge per unit.

Sample Script: Hi, I've had associate account with you for six years and i have ne'er had a late payment. i might prefer to visit you regarding lowering my charge per unit. contestant Bank is presently providing an analogous card at seventeen.7% interest, that is considerably not up to my rate of twenty four.9%.

4-Pay for removal of assortment accounts. If you have got any credit accounts that have gone into collections, unremarkably the gathering entry would remain your credit report for seven years. However, you furthermore may have heaps of area to barter with assortment agencies and acquire the entry off from your credit report once you have paid the debt fully. These ar known as "pay for delete" agreements.[9]

- Many assortment agencies can send you a settlement supply. If you would like to own the entry off from your credit report, however, you sometimes got to pay over the settlement quantity. In some cases, you'll need to conform to pay what you owe fully.

Tip: Request a validation letter from the gathering agency before you pay them any cash to form positive you really owe the debt and that they have the correct to gather it.

Method:3-Using Credit Responsibly

|

| How to Fix Your Credit |

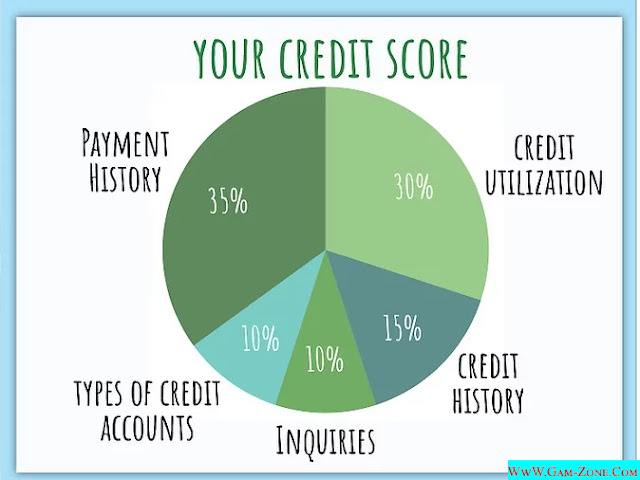

1-Review what factors come in scheming your credit score. It will take months of diligence to induce your credit score wherever you would like it to be. Once you savvy there, attempt to stay it there or take it even higher. Knowing however your credit score is calculated will assist you remain prime of it. Generally, a FICO score is calculated in step with the following:[10]

- Your payment history makes up regarding thirty fifth of your score. Even one late payment are often enough to drop your score a couple of points, therefore it is vital to pay all of your bills early or on time, every time.

- About half-hour of your score is predicated on your credit utilization, that appearance at the number of outstanding debt you have got relative to the credit you have got out there. If you have got to hold a balance on a mastercard, confirm it is not over twenty fifth or half-hour of your total out there credit.

- About V-J Day of your credit score is predicated on your credit history. to stay this portion of your credit score sound, avoid closing your oldest accounts.

- Inquiries frame regarding 100 percent of your credit score. attempt to not apply for over two or three new lines of credit per annum to avoid a negative impact on your score.

- The final 100 percent of your credit score deals with the various varieties of credit accounts you have got. Ideally, you would like a mixture of credit cards, auto loans, a mortgage, and alternative varieties of installment accounts.

Tip: detain mind that there is no single formula for evaluating your trustiness. completely different lenders or finance corporations could place weight on various factors, despite your overall credit score.

2-Create a monthly budget and continue it. All the diligence you place into fixing your credit can attend waste if you finish up obtaining yourself in debt once more as a result of you are over-extended. discover your actual net financial gain every month and deduct from that the bills you have got no management over, like your utilities, rent or mortgage payment, food, and transportation prices.[11]

- If you discover that you simply have a deficit every month, see what you'll do to chop your expenses. for instance, you'll be able to furnish bulk and share with friends and family to cut back food prices.

- Getting a aspect gig is an alternative choice if you discover you have got perennial issue creating ends meet. sign language up with a ride-share app or a delivery service might web you a touch further money. for instance, you may do ride-sharing on weekends to hide your automobile payment.

3-Calculate truth price of high-ticket purchases before you purchase. It are often tempting to plonk a mastercard if you would like to shop for a replacement TV, vice system, or pc. however albeit your monthly payments is also comparatively low, you may pay heaps a lot of for that item in interest, particularly if it takes you many years to pay down the balance.[12]

- For example, suppose you see a replacement pc that you simply wish for $3,000. you may place it on your mastercard and pay the minimum payment of $60 a month. However, if your charge per unit is V-J Day, this can find yourself cost accounting you a further $400 around a year. Even worse, if you simply create the minimum payment, it's going to take you sixteen years to pay it off! By then, the computer would be past obsolete and you'd have paid your mastercard company $3,641 in interest – over the initial injury of the computer.

Tip: If you are looking at a high-ticket item, attempt to use a card that gives no interest on massive purchases as long as you pay them off during a specific amount of your time. However, take care to browse the fine print. Some corporations can charge you accumulated interest on the remaining balance if you do not pay it off within the time assigned.

4-Pay your bills on time and full.

produce a bill calendar and write down every bill on the day that it's due. this could assist you keep track of your bills so that they do not creep up on you. you'll additionally set reminders on your pc or smartphone. attempt to pay your mastercard balances fully each month whenever doable.[13]

- Setting up autopay are often a decent choice to make sure that you do not miss a payment maturity date. However, confirm you are going to own enough cash in your checking account to truly cowl the bill. Otherwise, you'll get hit with fees for bill of exchange or came payment.

Tip: If you create an outsized purchase on a mastercard that you simply cannot pay fully, a minimum of attempt to pay over the minimum payment every month to induce the balance down.

5-Use a credit chase app to stay on prime of your credit score. There ar variety of free credit chase apps, like Credit fate, Credit benni, and WalletHub, that enable you to envision your credit score for changes whenever you would like. several of those apps even have budgeting and coming up with options that may assist you nevertheless your next huge purchase.[14]

- Make a habit of checking your credit a minimum of double a month. If you have had errors on your credit report before, or are a victim of fraud, you'll wish to envision it a lot of typically.

6-Avoid the temptation to use for brand new credit cards. each time you apply for a mastercard, associate inquiry goes on your credit report. whereas inquiries solely frame regarding 100 percent of your total credit score, most creditors look squint-eyed at candidates World Health Organization have applied for a big range of recent credit cards or loans.[15]

- If you are buying a automobile or a house, most creditors can take this into thought. However, if you are simply applying for a bunch of credit cards, it makes it seem like you are having monetary bother.

Recommended content :

How To Screenshot on IPhone Xr

How To Screenshot on IPhone Xr

Post a Comment